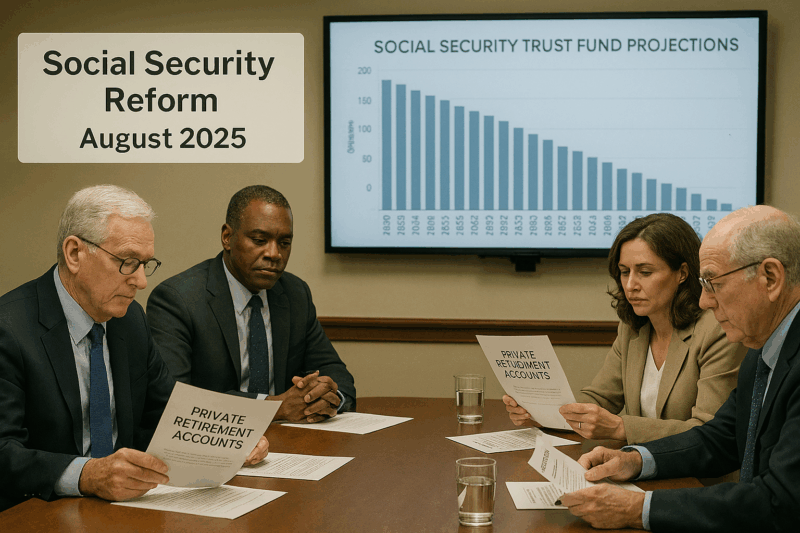

Social Security faces a looming crisis, with its trust fund projected to be depleted by late 2032, leading to a 24% benefit cut unless reforms are enacted. Les Rubin, founder of Main Street Economics, argues that transitioning to private retirement accounts offers a sustainable solution to the program’s pay-as-you-go flaws. This approach, detailed in an August 2025 opinion piece, aims to replace the broken system with individually owned assets, promising higher retirement income and economic stability. Focus keywords: Social Security reform, private retirement accounts, trust fund crisis, payroll tax, retirement income.

Human Toll

Impact on Current and Future Retirees

The trust fund crisis threatens millions of retirees who rely on Social Security for 31% of their income, with 39% of men and 44% of women over 65 depending on it for at least half their income. Without reform, a 24% benefit cut in 2032 could push many into poverty. Younger workers, burdened by payroll taxes that fund current retirees without accumulating savings for their own future, face diminishing returns in a system Rubin calls a “Ponzi scheme.”

Economic and Social Implications

The Social Security reform debate affects workers, employers, and the broader economy. The current system’s deficits, coupled with a national debt nearing 125% of GDP, exacerbate financial instability. Transitioning to private retirement accounts could empower workers with ownership over their savings but requires navigating significant transitional costs, impacting current workers and retirees during the shift.

Facts

Current System’s Flaws

Social Security’s pay-as-you-go model, where current workers’ payroll taxes fund current retirees, is unsustainable due to a declining worker-to-retiree ratio. The Old-Age and Survivors Insurance (OASI) trust fund is projected to run dry by 2033, with unfunded liabilities in the tens of trillions. Past fixes, like raising payroll taxes and the retirement age, have failed to address this structural flaw. Rubin proposes a 20-year transition to private retirement accounts, where contributions are invested in professionally managed accounts, yielding higher retirement income.

Transition Plan

Rubin’s plan ensures current retirees retain benefits while new retirees receive a mix of Social Security and private account payouts until the system is fully privatized by year 20. The funding gap during this transition would be covered by modest increases in contributions from employees, employers, and the government, which would phase out once the trust fund is obsolete. This approach mirrors successful privatizations in countries like Chile, where individual accounts boosted savings and economic growth.

Climate Context

Fiscal and Demographic Pressures

The trust fund crisis is part of a broader fiscal challenge, with U.S. debt projected to hit 200% of GDP in coming decades. An aging population and fewer workers exacerbate Social Security’s deficits. Private accounts could reduce government liabilities by shifting responsibility to individuals, promoting economic growth through market investments. However, critics argue that market volatility and high administrative costs could undermine these benefits, favoring simpler fixes like tax increases or benefit adjustments.

What Lies Ahead

Challenges and Opportunities

Implementing Social Security reform via private retirement accounts faces hurdles, including public skepticism and opposition from groups like AARP, which historically resisted privatization. The transition’s financial burden requires careful management to avoid disrupting current retirees. However, successful models in countries like Chile and Sweden show that privatization can yield higher retirement income and generational wealth. Public support and clear communication are critical to overcoming past failures, such as President Bush’s 2005 proposal.

Conclusion

The Social Security reform proposed by Rubin offers a bold path to address the trust fund crisis through private retirement accounts. By empowering workers with ownership and eliminating unfunded liabilities, this approach promises a sustainable future with higher retirement income. Despite transitional challenges, the urgency of reform demands action to prevent devastating benefit cuts. Policymakers must build public support to ensure a fair and permanent fix for America’s retirement system. Focus keywords: Social Security reform, private retirement accounts, trust fund crisis, payroll tax, retirement income.