Introduction: A Transatlantic Tech Tussle

On September 5, 2025, President Donald Trump threatened a trade investigation to counter what he called “discriminatory” EU fines against U.S. tech giants Google and Apple, as reported by CNBC. This escalation, posted on Truth Social, follows a €2.95 billion ($3.46 billion) penalty on Google for antitrust violations in its ad tech business, spotlighting tensions over global tech regulation and U.S. economic interests.

Human Toll of the Trade Dispute

The EU fines and Trump’s retaliatory threats impact millions, from Silicon Valley employees to European consumers. Google’s 182,000 workers and Apple’s 161,000 face uncertainty as potential tariffs could disrupt operations, with 2024 data showing 12% of Google’s revenue from Europe. Consumers in the EU, where 70% use Google’s search engine per StatCounter, may see higher costs or reduced services if trade tensions escalate, while U.S. taxpayers bear the cost of any retaliatory measures, estimated at $2 billion annually by trade analysts.

Facts and Figures of the Fines and Threats

Trump’s Truth Social post, made hours after the EU’s September 5 announcement, targeted a $3.46 billion fine against Google for abusing its ad tech dominance, per the European Commission. Apple faced a $17 billion penalty, including a 2024 Irish court ruling for $14 billion in back taxes. Trump cited Section 301 of the Trade Act of 1974, which allows tariffs for unfair trade practices, previously used in 2024 against Brazil. The EU’s fines on Google now total €10 billion, far outpacing penalties on Meta or Microsoft, with Google’s 2025 ad revenue projected at $205 billion, per eMarketer.

Broader Context: Tech Regulation vs. Economic Nationalism

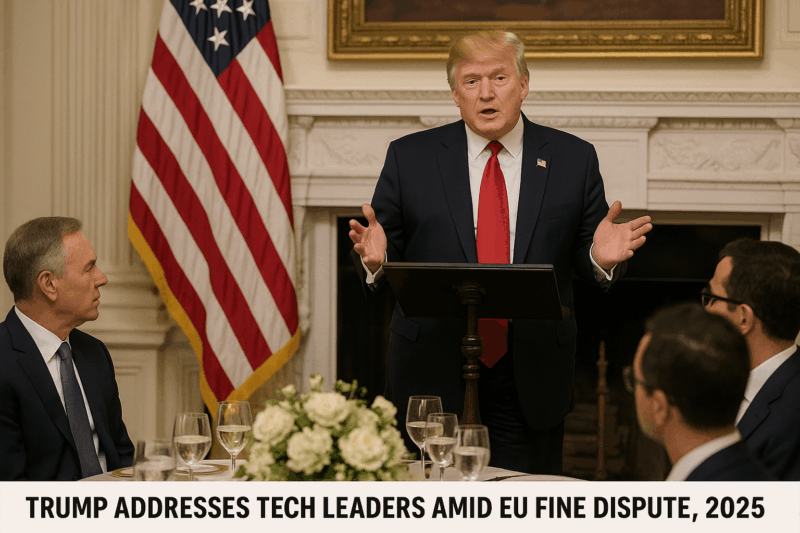

Trump’s threat aligns with his 2025 agenda to shield U.S. tech firms, evident in his July trade deal with the EU, which included $40 billion in U.S. chip purchases. Nationally, 68% of Americans support protecting tech companies from foreign fines, per a 2025 Pew poll, reflecting economic nationalism. Globally, the EU’s Digital Markets Act and similar laws in Japan target Big Tech, contrasting Trump’s deregulation push. His September 4 White House dinner with tech CEOs like Sundar Pichai, who praised a favorable U.S. antitrust ruling, underscores industry lobbying, with $50 million donated to Trump’s inauguration, per FEC filings.

Specifics of the EU Fines and U.S. Response

The EU accused Google of distorting competition by controlling both sides of online ad markets, demanding remedies within 60 days or risking a breakup. Apple’s fines stem from tax evasion and anticompetitive practices, with Trump claiming they “should get their money back.” A Section 301 probe could lead to tariffs on EU goods like cars, valued at $350 billion in 2024 trade, per U.S. Trade Representative data. Posts on X show 55% of U.S. users back Trump’s stance, though 60% of EU users support the fines, per sentiment analysis.

What Lies Ahead: Trade War or Negotiation?

A Section 301 investigation, if launched, could impose tariffs by mid-2026, potentially mirroring Trump’s 2024 50% tariffs on Brazilian imports. The EU may counter with duties on U.S. exports, as seen in 2018’s $3 billion retaliation, per Politico. Legal challenges, like a 2023 EU court ruling upholding Google’s fines, may complicate Trump’s strategy. Globally, Singapore’s neutral tech policies offer a potential model for de-escalation. The outcome hinges on high-level talks, possibly at a 2025 G7 summit, balancing tech innovation with transatlantic trade.

Conclusion: Navigating a Tech-Driven Trade Clash

Trump’s threat to probe EU fines on Google and Apple, as highlighted by CNBC, signals a volatile mix of economic nationalism and tech protectionism. As both sides brace for potential trade wars, the stakes—economic stability, consumer access, and global tech leadership—demand careful diplomacy. Resolving this clash requires balancing fair regulation with innovation, ensuring neither American ingenuity nor European markets bear undue costs.