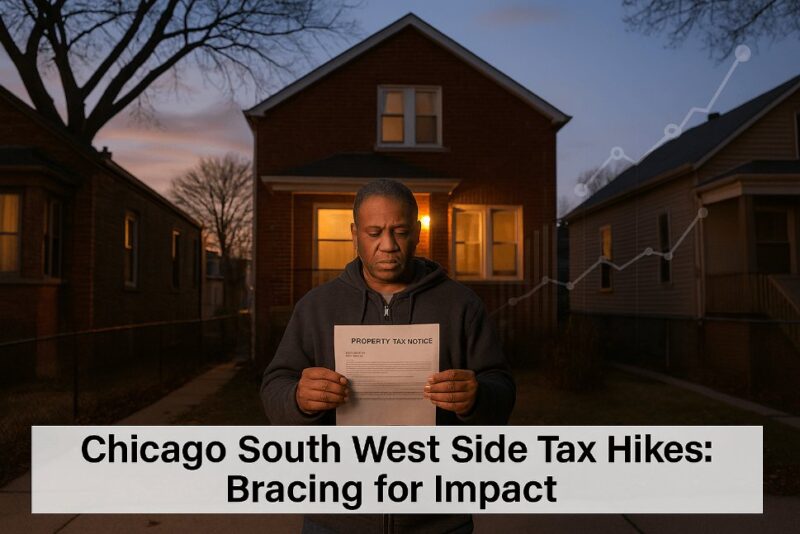

A Neighbourhood’s Hope Meets a Tax Bill’s Sting

On a quiet block in Austin, where red-brick homes whisper of resilient dreams, Leodus Thomas Jr. stands in his yard, gazing at the fixer-upper he poured his heart into nine years ago. What began as a developer’s vision for revival now feels like a gut punch: a property assessment that surged 60%, promising a $700 spike in his annual tax bill. Across Chicago’s South and West sides, thousands like Thomas face the same shadow—assessments doubling or tripling amid investor influxes into long-affordable enclaves. As fall’s chill sets in, these hikes aren’t just numbers; they’re a quiet erosion of stability, turning neighborhood pride into quiet worry for families fighting to hold on.

Families Squeezed by Unseen Burdens

Leodus Thomas Jr.’s story cuts deep. A West Side developer who bought his home for $135,000 in 2016, he watched its assessment climb from $163,000 to $260,000—logical in a reviving market, but punishing for his reinvestment plans. “We get properties back on the tax roll, but lately we’ve been punished big-time,” he says, his voice heavy with the weight of stalled dreams. For single moms in Englewood or elders in Roseland, where medians jumped 119-160%, the math is merciless: a $1,300 bill could balloon to $2,500, forcing choices between groceries and mortgages.

These aren’t faceless stats; they’re retirees like Maria Gonzalez in North Lawndale, who inherited her home and now eyes selling—only to find pricier neighborhoods out of reach. A recent study reveals the cruel irony: lowest-income owners, least likely to appeal, shoulder the heaviest load. Amid Chicago’s affordability crisis, these hikes amplify isolation, where community bonds fray under fiscal strain, leaving families to whisper, “We fought for this block—now it’s fighting us.”

The Scale of Surging Assessments

The Cook County assessor’s 2024 reassessment hit South and West sides hardest: 37,000 residential properties saw values double or more from 2023, per an Illinois Answers Project and Chicago Tribune analysis. Citywide median hike: 22%. Mayor Brandon Johnson’s Austin home rose 35%, but Englewood’s median leaped 119%, Roseland 160%. Gold Coast? A mere 3%.

These jumps stem from investor-driven sales, reversing 2021’s 32-34% drops in places like West Garfield Park, where bills fell from $2,441 to $1,345 medians. Yet taxes won’t double outright—final bills, due later 2025, factor levies from cash-strapped Chicago Public Schools (biggest chunk) and the city. Rule of thumb: Above 22% hikes signal bigger bills, warns Assessor Fritz Kaegi’s chief of staff Scott Smith.

| Neighborhood | Median Assessment Increase | Example Bill Impact |

|---|---|---|

| Englewood | 119% | $1,308 → ~$2,800 potential |

| Roseland | 160% | $677 → ~$1,800 potential |

| North Lawndale | 140% | $1,200 → ~$2,600 potential |

| Citywide Median | 22% | Gradual rise, less shock |

Broader Fiscal Context: A System Stacked Against Revival

Investor flocks to affordable pockets—post-2021 sales in disinvested areas spiked values—clash with systemic woes. Kaegi’s 2021 corrections fixed overassessments, but Board of Review appeals shifted $2 billion in taxes from commercial to residential owners (2021-2023), per Treasurer’s study. Low-income areas appeal least, adding regressivity: poorer homes assessed higher relative to value.

Fiscal pressures mount: CPS and city crises, plus hikes from parks and water districts, inflate levies. Kaegi’s stalled “circuit breaker” bill—$200 million state credit for 25%+ spikes—highlights Springfield’s budget bind. Echoing national trends, like NYC’s post-pandemic surges, Chicago’s hikes risk gentrification’s double edge: revival, but at the cost of displacing those who held the line.

What Lies Ahead: Appeals, Exemptions, and Hard Fought Relief

Homeowners have until December 2025 deadlines to appeal via the Board of Review—Kaegi’s office urges using dashboards for comps. Exemptions for seniors, vets, or low-income could shave 20-50% off bills; new state law mandates treasurer notices. Workshops streamed, but critics say outreach lags, especially in hard-hit townships.

Kaegi’s circuit breaker push resumes in Springfield, while Board seeks budget boosts for equity. For Thomas, it’s back to appeals: “You might win, but they’ll climb again.” Resilience means community action—block clubs sharing appeal tips, developers like Thomas advocating. Globally, models like Toronto’s tax caps offer lessons, urging Chicago toward progressive relief to sustain revival without ruin.

Conclusion: Holding On Amid Chicago South West Side Property Tax Hikes

As leaves turn in Austin and Englewood, Chicago’s South and West side property tax hikes cast a long shadow over hard-won progress. For Leodus Thomas Jr. and neighbors, these surges test the spirit of communities that refused to fade. Yet in their resolve—to appeal, adapt, advocate—lies hope: a city that taxes fairly, invests justly. Let this moment spur reform, ensuring revival lifts all, not just the ledger.