The proposed new Republican tax bill, dubbed “Tax Cut 2.0” by supporters and critics alike, is being promoted by former President Trump as another “big, beautiful tax cut” for Americans. However, a critical analysis reveals it may repeat and even deepen the economic issues sparked by its 2017 predecessor. This new Republican tax bill aims to make previous cuts permanent and slash corporate taxes further, but opinion leaders are sounding the alarm about its potential impact on the national debt and its fairness for the average American family.

The “Big, Beautiful” Promise vs. The Critical Reality

The central promise of the new Republican tax bill is to stimulate the economy by leaving more money in the hands of corporations and individuals. Proponents argue that lowering the corporate tax rate further from 21% will make America more competitive and lead to job creation. However, critics point to the 2017 tax cuts as a cautionary tale. That bill, they argue, failed to deliver on its promises of a business investment boom and instead primarily benefited the wealthiest 1%, while adding trillions of dollars to the national debt.

Flaw #1: An Explosion of National Debt

The most alarming projection for the new tax plan is its impact on the national debt. The 2017 cuts never “paid for themselves” as promised, and making them permanent would lock in trillions of dollars in reduced government revenue over the next decade. Further cutting the corporate rate would compound this problem, creating a massive fiscal hole that would ultimately need to be filled by future generations, either through drastic cuts to services like Social Security and Medicare or future tax hikes.

The Scale of the Debate: 2 Critical Flaws Examined

The debate over the Republican tax bill boils down to two fundamental, critical flaws that opponents say will define its legacy. These issues mirror the criticisms of the 2017 law but on a potentially larger scale.

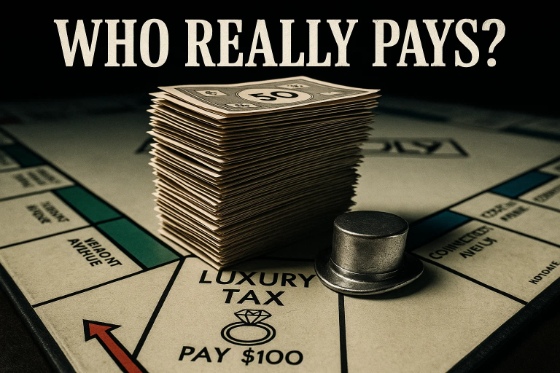

- Flaw 1: Disproportionate Benefits for the Wealthy: The structure of the proposed cuts, particularly making the individual cuts permanent and slashing corporate rates, overwhelmingly favors high-income earners and shareholders. The article argues that middle-class families would see only a fraction of the benefits, while the wealthiest Americans would enjoy a massive windfall.

- Flaw 2: Unsustainable Fiscal Policy: The plan lacks a mechanism to pay for the steep tax reductions. This would force the U.S. to borrow trillions more, increasing the national debt to potentially unsustainable levels and risking long-term economic stability for a short-term stimulus.

Will History Repeat Itself? Lessons from the 2017 Tax Cuts

To understand the risks of the new Republican tax bill, one only needs to look at the recent past. The Tax Cuts and Jobs Act of 2017 was passed with similar promises of boosting wages and investment. Instead, many corporations used their tax savings on stock buybacks, which enriched executives and shareholders rather than boosting worker pay or domestic investment. The national debt, which was already high, ballooned under these cuts. Critics argue that “Tax Cut 2.0” is not a new vision but simply a doubling down on a failed economic theory.

What This Means for the American Middle Class

While proponents claim the bill will help everyone, the fine print suggests a different story. For the middle class, the expiration of the 2017 individual tax cuts already looms as a potential tax increase. While making them permanent sounds good, it comes at a tremendous cost to the national debt. Opponents argue this is a classic bait-and-switch: a small, temporary benefit for the middle class in exchange for massive, permanent benefits for corporations, paid for by the nation’s collective credit card. The long-term result could be less funding for public services that middle-class families rely on.

Conclusion

The push for a new Republican tax bill presents a critical choice for the country. Is it a “big, beautiful” plan that will unleash economic prosperity for all, or is it an alarming sequel that will further enrich the wealthy, explode the national debt, and leave the middle class behind? The lessons from 2017 suggest extreme caution is warranted. As the debate intensifies, voters must look past the slogans and examine who truly stands to benefit from this massive fiscal experiment before the nation locks itself into another decade of what critics call unsustainable and inequitable economic policy.