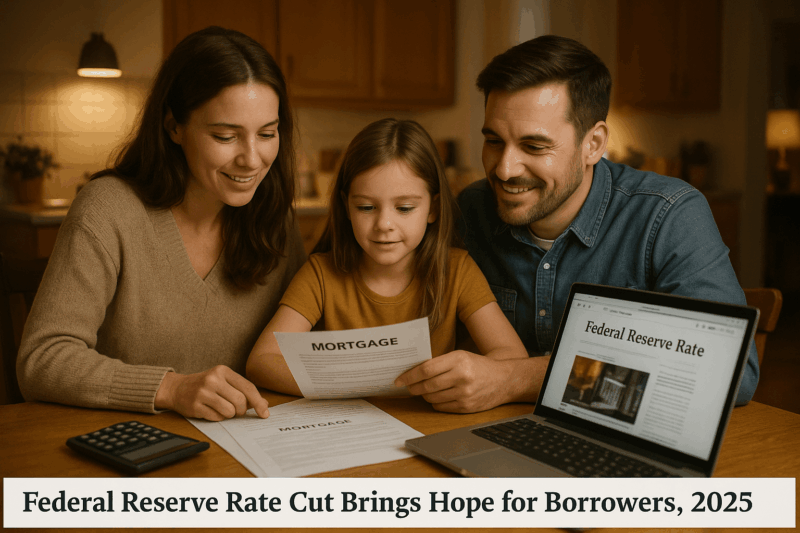

A Glimmer of Relief for American Households

In a small town in Ohio, Sarah Thompson, a single mother of two, sits at her kitchen table, crunching numbers on her laptop. She’s been dreaming of buying a home, but soaring mortgage rates have kept that dream out of reach. This week, the Federal Reserve’s decision to cut interest rates by a half percentage point—the first cut in over four years—offers a flicker of hope for families like Sarah’s, signaling potential relief for borrowers nationwide. The move, announced on September 17, 2025, aims to ease financial pressures as inflation cools, but what does it mean for everyday Americans?

Impact on Borrowers and Families

The Federal Reserve’s rate cut lowers the federal funds rate to a range of 4.75% to 5%, a significant shift from the 23-year high of 5.25% to 5.5%. For consumers, this translates to lower borrowing costs. Mortgage rates, which peaked at 7.79% in October 2023, have already begun to decline, with 30-year fixed-rate mortgages averaging 6.09% as of September 12, 2025, according to Freddie Mac. For Sarah, this could mean saving hundreds of dollars monthly on a home loan, making homeownership more attainable.

Car buyers are also poised to benefit. Auto loan rates, which surged to 7.4% for new cars and 11.9% for used vehicles in mid-2025, are expected to ease slightly. This could help families like the Thompsons afford a reliable car, crucial for work and school commutes. However, experts caution that the relief may be gradual, as lenders adjust to the Fed’s new policy.

Facts and Figures of the Rate Cut

The Federal Reserve’s decision, led by Chair Jerome H. Powell, reflects confidence that inflation, which dropped to 2.5% in August 2025, is nearing the Fed’s 2% target. The half-point cut, larger than the anticipated quarter-point reduction, signals a proactive stance to support economic growth. The Fed also projects two additional quarter-point cuts by year-end, potentially lowering the federal funds rate to 4.25% to 4.5%.

For a $300,000, 30-year mortgage, a drop from 6.5% to 6% could save borrowers approximately $100 per month, per Bankrate calculations. Auto loans, averaging $40,000 for new cars, could see monthly payments decrease by $20-$30 with a 0.5% rate reduction. However, credit card rates, tied to the prime rate, may remain high, as issuers are slower to pass on savings.

Broader Economic Context

The rate cut comes amid a complex economic landscape. Inflation, while cooling, remains above the Fed’s target, and fears of a slowing job market loom. The unemployment rate, at 4.2% in August 2025, prompted the Fed to act decisively to prevent a recession. Historically, rate cuts have spurred economic activity, as seen in the post-2008 recovery, but today’s high debt levels—$1.1 trillion in credit card debt alone—raise concerns about uneven benefits. Wealthier households may refinance mortgages, while lower-income families with credit card debt may see little immediate relief.

What Lies Ahead for Borrowers

The Fed’s move signals a shift toward economic optimism, but challenges remain. Home prices, still near record highs, could limit affordability despite lower rates. Lenders may also tighten credit standards, making loans harder to secure for some. Financial advisors urge consumers to act strategically: refinance existing loans, shop for competitive rates, or delay major purchases until further cuts materialize. Globally, central banks like the European Central Bank are also easing rates, suggesting a coordinated effort to bolster growth.

Looking Toward a Brighter Financial Future

For Sarah Thompson and millions of Americans, the Federal Reserve’s rate cut is a beacon of hope in a challenging economy. While the full impact will unfold over months, the prospect of lower mortgage and auto loan rates offers a chance to rebuild financial stability. As families navigate this shifting landscape, the Fed’s actions remind us that small changes in policy can ripple into big dreams—like a new home or a reliable car—becoming reality.