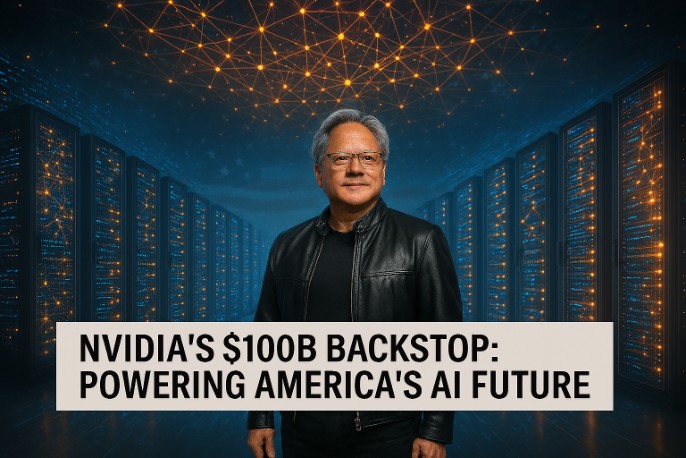

A Chip Giant’s Massive Wager on Tomorrow’s Tech

In the humming server farms of America’s heartland, where silicon dreams power the next industrial revolution, Nvidia isn’t just building chips—it’s bankrolling the future. On September 23, 2025, whispers from Silicon Valley confirmed a seismic shift: Nvidia’s $100 billion infusion into OpenAI, financing a colossal data center expansion amid the startup’s fiscal wobbles. CEO Jensen Huang, the visionary at the helm, isn’t stopping there—$5 billion into rival Intel, stakes in cloud upstart CoreWeave, and ties to Elon Musk’s xAI paint a portrait of a company wielding its $3 trillion war chest like a conductor’s baton. For innovators like Sarah Lee, a 28-year-old AI ethicist in Austin whose startup teeters on compute costs, this isn’t corporate chess—it’s a lifeline, evoking the quiet thrill of barriers crumbling and breakthroughs beckoning in an AI arms race that’s as exhilarating as it is existential.

Innovators Fueled, Workers Uplifted

Sarah Lee’s eyes light up recounting her late-night code sprints, but the bill for cloud GPUs once forced her team to pause: “We had ideas that could spot cancer patterns, but no horsepower.” Nvidia’s ecosystem investments—pouring capital into partners like OpenAI—change that, slashing costs for startups and letting dreamers like her scale without selling souls. Huang’s philosophy resonates: “We’re not just selling picks and shovels; we’re mining the gold with you,” he quipped in a recent earnings call, his words a balm for the 1 million+ AI devs worldwide scraping by on waitlists.

For factory workers in upstate New York, Intel’s Nvidia-backed fabs mean jobs—thousands in chip assembly, a ripple for families like the Garcias, where dad Miguel traded auto lines for precision soldering. Yet the human ledger balances precariously: OpenAI’s “shaky finances” pre-deal left contractors unpaid, a stark reminder that booms can bust dreams. In this gold rush, Nvidia’s bets uplift underdogs but underscore inequities—rural coders sidelined by urban compute hubs, ethicists like Lee advocating for inclusive access amid the hype.

Nvidia’s AI Arsenal in Numbers

Nvidia’s 2025 playbook blends silicon supremacy with strategic cash: Q2 revenue hit $30 billion (up 122% YoY), fueled by H100/H200 GPUs powering 80% of AI training workloads. The OpenAI deal alone—$100 billion for data centers—dwarfs Microsoft’s $13 billion stake, addressing OpenAI’s projected $5 billion 2025 burn rate.

Core metrics from the surge:

| Investment | Amount | Partner | Impact |

|---|---|---|---|

| OpenAI Data Centers | $100B | OpenAI | Funds 10+ massive facilities; stabilizes finances amid $5B annual losses |

| Intel Chip Design | $5B | Intel | Bolsters U.S. manufacturing; creates 3,000+ jobs in Ohio fabs |

| CoreWeave Cloud | Undisclosed (est. $1B+) | CoreWeave | Expands GPU cloud; serves 500+ AI firms, cutting compute costs 40% |

| xAI Partnership | Stakes + tech | xAI (Musk) | Integrates Nvidia chips into Grok AI; accelerates 1M-GPU supercluster |

| Nvidia Revenue | $30B (Q2 2025) | N/A | 80% AI-driven; market cap $3T, up 150% YTD |

Huang’s quote: “Investor confidence lets us backstop the ecosystem—without it, AI stalls.” Challenges: Supply chain snarls delay H200 deliveries by 20%.

U.S. AI Ascendancy Amid Global Jostles

Nvidia’s moves fortify America’s AI fortress: With China barred from advanced chips via export curbs, U.S. dominance—90% market share—shields against Huawei’s homegrown rivals. OpenAI’s expansion counters Europe’s lag (5% global AI investment) and India’s talent exodus, but risks over-reliance: A 2025 GAO report warns U.S. data centers could guzzle 8% of national power by 2030, straining grids from Texas to Virginia.

Echoing the 1990s dot-com boom, Nvidia’s bets mirror Intel’s PC era fueling—yet with ethical thorns: Bias in AI models, job displacements in creative fields. Globally, Taiwan’s TSMC (Nvidia’s foundry) eyes U.S. plants amid tensions; domestically, Biden-era CHIPS Act ($52B) amplifies Huang’s vision. For Lee, it’s dual-edged: “Nvidia’s boom births tools for good, but who watches the watchers?”

Superclusters, Scrutiny, and Sustainable Scale

By 2026, OpenAI’s Nvidia-backed centers could train models 10x faster, slashing inference costs 50% for apps like drug discovery. Intel’s infusion eyes 2nm chips by 2027, diversifying supply. Huang teases “AI factories” in 10 states, creating 50,000 jobs, but faces headwinds: EU antitrust probes, U.S. energy mandates.

Resilience? Partnerships like xAI’s 1M-GPU cluster democratize access via APIs. For workers, upskilling via Nvidia’s DLI program (1M certified). Globally, alliances with Samsung counter China’s push; ethically, Huang pledges “responsible AI” audits. Success: A boom that builds bridges, not silos—empowering Lee’s startups to thrive.

Nvidia’s Backstop in America’s AI Ascent

Nvidia’s $100 billion OpenAI lifeline and beyond isn’t just investment—it’s the scaffolding for America’s AI edifice, where Huang’s gambles turn compute scarcity into creative abundance. As Sarah Lee codes through the night and Miguel Garcia solders new futures, this backstop demands balance: Innovation unfettered, equity ensured. In the chips’ glow, may Nvidia’s bets yield not just booms, but a brighter, bolder tomorrow—for coders, communities, and the code that connects us all.