Trump Demands Goldman Sachs Fire Economist Over Tariff Stance

Trump Demands Goldman Sachs Fire Economist, Escalating War on Economic Dissent

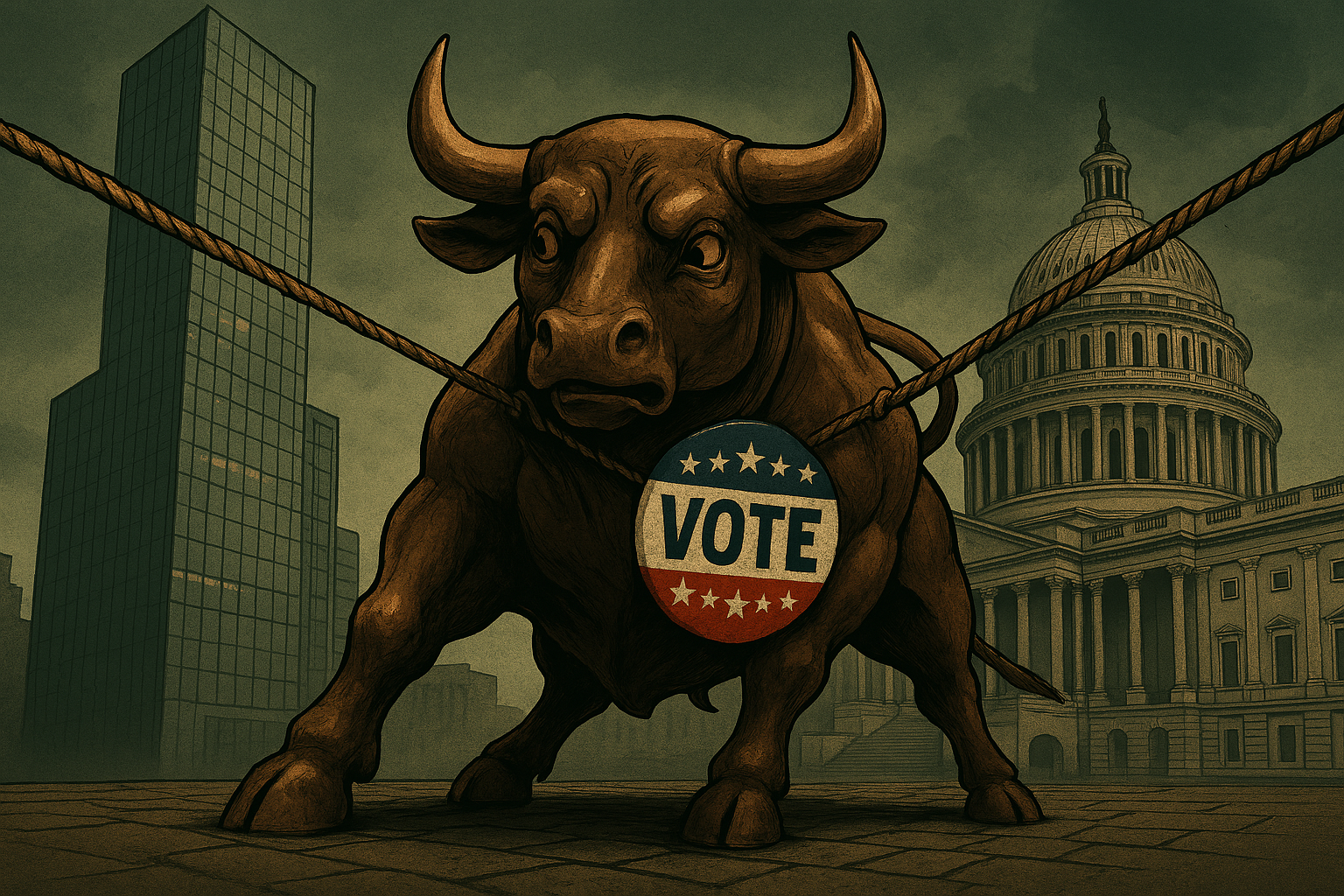

In an unprecedented public demand, former President Donald Trump has called on Goldman Sachs to fire one of its top economists for publishing a report critical of his proposed across-the-board tariffs. The move represents a stunning escalation in his efforts to command loyalty from corporate America and silence economic dissent, effectively turning a routine financial analysis into a high-stakes political loyalty test for one of Wall Street’s most powerful firms.

This demand by Trump for Goldman Sachs to fire an economist is more than just a political jab; it’s a direct challenge to the long-standing independence of economic research at major financial institutions. The incident has sent a chill through Wall Street, raising concerns about the potential for political retribution against firms that produce analysis unfavorable to a potential administration.

The Catalyst: A Critical Report on Tariffs

The controversy erupted after Goldman Sachs’ chief economist, Jan Hatzius, released a detailed analysis of Trump’s proposal to implement a 10% universal tariff on all imported goods. The report, intended for the firm’s clients, concluded that such a policy would likely:

- Increase consumer prices significantly, fueling inflation.

- Disrupt global supply chains, harming U.S. businesses.

- Trigger retaliatory tariffs from other countries, hurting American exports.

- Fail to achieve its stated goal of reducing the trade deficit.

The report is a mainstream, data-driven analysis, reflecting a broad consensus among economists about the potential negative impacts of widespread tariffs.

The Demand: A Test of Corporate Allegiance

In response to the report, Trump took to social media, personally attacking the economist and the firm. “Goldman Sachs should fire this economist immediately,” Trump wrote. “They are working against America’s interests. Their loyalty should be to our country, not to globalists.”

This public demand places Goldman Sachs in an incredibly difficult position. It pits their commitment to independent, objective research against immense political pressure from a leading presidential candidate. The firm’s response is being watched closely as a bellwether for how corporate America might navigate a political environment where economic dissent is punished.

A Chilling Effect on Wall Street and Beyond

The primary concern among business leaders and economists is the potential for a “chilling effect.” If a firm like Goldman Sachs were to bow to political pressure, it would signal that independent analysis is no longer safe.

This could lead to:

- Self-Censorship: Research departments at other banks and institutions might soften or avoid publishing analysis that could be perceived as critical of a potential administration’s policies.

- Erosion of Trust: The credibility of Wall Street research would be damaged if it were seen as being influenced by political threats rather than objective data.

- Politicization of Data: It contributes to a broader trend of treating economic data and forecasts as political weapons rather than neutral tools for decision-making.

“The moment research is tailored to fit a political narrative, it ceases to be research,” commented a former Federal Reserve official. “It becomes propaganda. That’s a dangerous road for our financial markets to go down.”

Conclusion: Wall Street on a Political Tightrope

The demand for Goldman Sachs to fire an economist is a defining moment in the relationship between Washington and Wall Street. It forces a powerful institution to choose between its professional integrity and political expediency. Goldman Sachs’ decision will send a powerful message about whether corporate America is prepared to defend the independence of its research or if it will adapt to a new reality where economic analysis must first pass a political loyalty test. The outcome will have lasting implications for the flow of information and capital in the U.S. economy.