Trump Demands Intel CEO Resign Over China Ties in 2025

Trump Demands Intel CEO Resignation Over China Ties in 2025

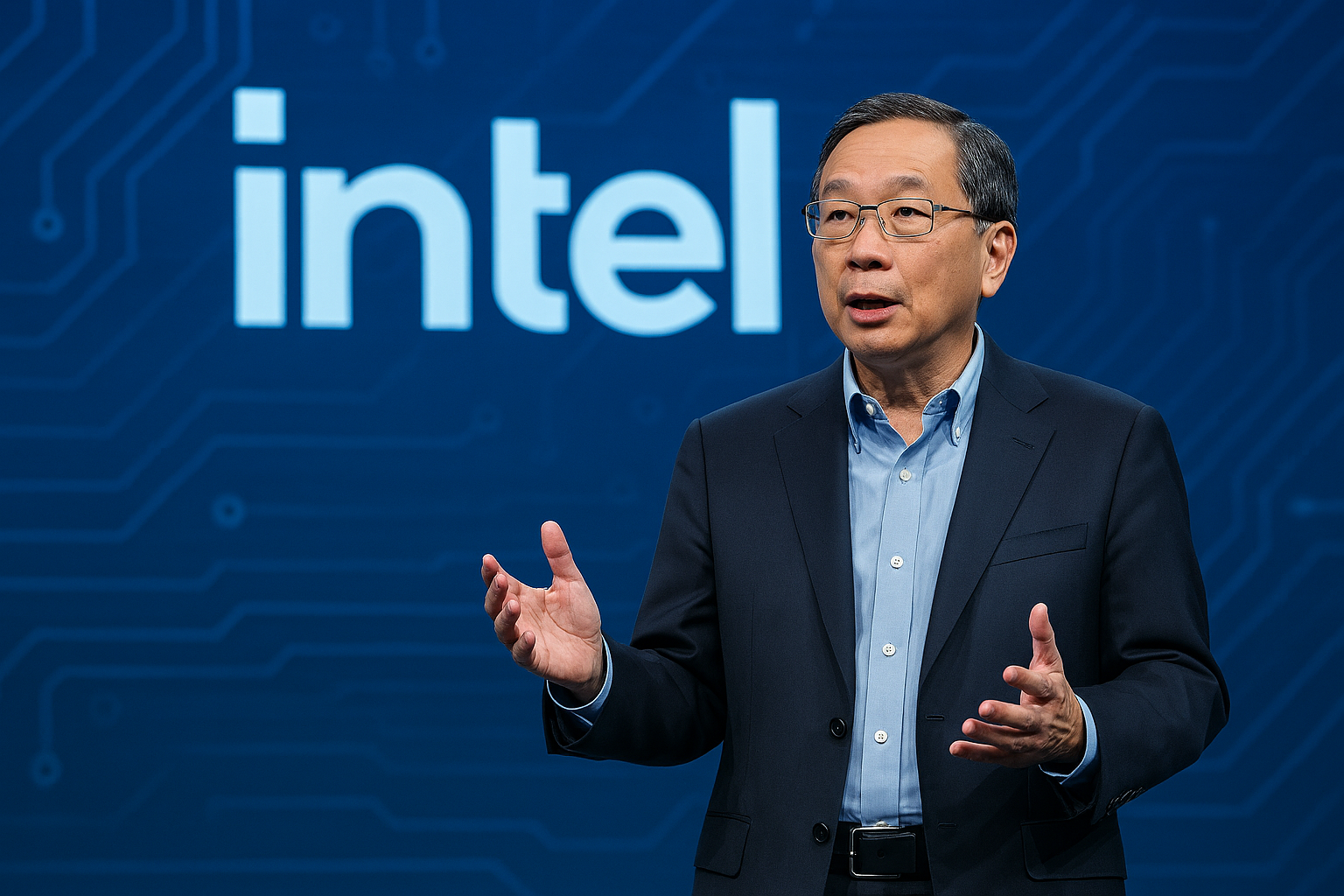

On August 7, 2025, President Donald Trump demanded the immediate resignation of Intel CEO Lip-Bu Tan, labeling him “highly conflicted” due to his investments in Chinese firms linked to the military. This unprecedented call, made via Truth Social, sent Intel shares down nearly 3% and sparked debate over federal intervention in corporate leadership. Amid U.S. efforts to bolster domestic chipmaking, the Trump demands Intel CEO resignation over China ties 2025 controversy raises questions about national security and corporate autonomy. How will Intel navigate this crisis? This article explores the demand, its context, and its broader implications.

Trump’s Demand and Tan’s China Connections

Trump’s call for Tan’s resignation stems from a Reuters report revealing that Tan invested at least $200 million in Chinese advanced manufacturing and chip firms between 2012 and 2024, some with ties to the People’s Liberation Army. Through his venture firm Walden, Tan holds stakes in 20 companies alongside Chinese government funds or state-owned enterprises. A source claimed Tan divested some holdings, but Chinese databases still list many as active. Senator Tom Cotton’s letter to Intel’s board further amplified concerns, questioning Tan’s past at Cadence Design, which settled a $140 million U.S. case over sales to a Chinese military university.

Intel’s Critical Role in U.S. Chipmaking

Intel, a cornerstone of the U.S. semiconductor industry, secured $8 billion in CHIPS Act subsidies in 2024 to build factories in Ohio and other states. However, the company faces challenges: its market value dropped below $100 billion in 2025, and it lags behind rivals like TSMC and Nvidia. Tan, appointed CEO in March 2025 after Pat Gelsinger’s ousting, has scaled back global expansion and cut jobs to revive Intel’s fortunes. The Ohio factory’s completion, now delayed to 2030–2031, and quality issues with new chip processes add pressure. Trump’s intervention risks destabilizing Intel at a critical time for U.S. tech independence.

Context: Trump’s Broader Policy Actions

This demand aligns with other 2025 Trump administration moves:

- UCLA Grant Freeze: On August 6, $584 million in UCLA research grants were frozen over antisemitism allegations, reflecting Trump’s use of federal leverage to enforce policy priorities.

- Tariffs and Trade: Trump’s 10% baseline tariff and country-specific rates (e.g., 34% on China) push for domestic manufacturing, as seen in Apple’s $600 billion U.S. investment commitment.

- Immigration Raids: A Los Angeles Home Depot raid on August 6 used a Penske truck as a “Trojan Horse,” raising profiling concerns.

- D.C. Police Takeover: Trump’s threat to federalize D.C.’s police and deploy the National Guard highlights his focus on centralized control.

These actions suggest a pattern of using federal authority to reshape economic, security, and social landscapes, with Intel as a high-profile target.

Reactions and Investor Concerns

Intel’s stock fell nearly 3% after Trump’s post, reflecting market unease. Investors like Phil Blancato of Ladenburg Thalmann warned that presidential interference sets a “very unfortunate precedent,” while David Wagner of Aptus Capital Advisors saw it as a signal of Trump’s commitment to U.S. business interests. On X, sentiments split: some praised Trump’s stance, with posts like “Protect our tech!” while others criticized it as overreach, citing “government meddling.” Intel reiterated its commitment to U.S. national security, but neither Tan nor the company directly addressed the resignation demand.

Critical Perspective: National Security vs. Corporate Freedom

The controversy raises valid concerns about Tan’s investments, given Intel’s role in national security and the CHIPS Act’s focus on reducing U.S. reliance on Chinese tech. However, the lack of evidence proving Tan’s actions compromised Intel’s operations suggests political motivations may be at play, especially amid Trump’s anti-China rhetoric. Critics argue the public demand risks destabilizing a struggling company critical to U.S. interests, while supporters see it as necessary accountability. The precedent of government-driven CEO ousters could chill corporate leadership, particularly in tech, where global ties are common. Intel’s board faces a delicate decision: replace Tan to appease policymakers or retain him to maintain continuity.

Conclusion

President Trump’s demand for Intel CEO resignation over China ties in 2025 underscores tensions between national security and corporate autonomy. As Intel navigates manufacturing challenges and CHIPS Act expectations, Tan’s leadership is under scrutiny. This move, alongside Trump’s tariffs, UCLA grant freeze, and other actions, reflects a broader strategy to assert federal control. The outcome will shape Intel’s future and U.S. tech policy. Share your thoughts on this controversy in the comments and follow for updates on this evolving story.

FAQ: Trump’s Demand for Intel CEO Resignation

- Why did Trump demand Lip-Bu Tan’s resignation?

Trump cited Tan’s $200 million investments in Chinese firms, some linked to the military, as a conflict of interest. - What is Intel’s role in U.S. chipmaking?

Intel is a key recipient of $8 billion in CHIPS Act subsidies to boost domestic semiconductor production. - How have investors reacted?

Intel’s stock dropped nearly 3%, with investors divided over Trump’s intervention as either necessary or overreach.

Key Details of the Intel Controversy

- Date: August 7, 2025

- Trigger: Trump’s Truth Social post demanding Tan’s resignation

- Investments: $200 million in Chinese firms, some with military ties

- Impact: Intel shares fell nearly 3%; Ohio factory delayed to 2030–2031