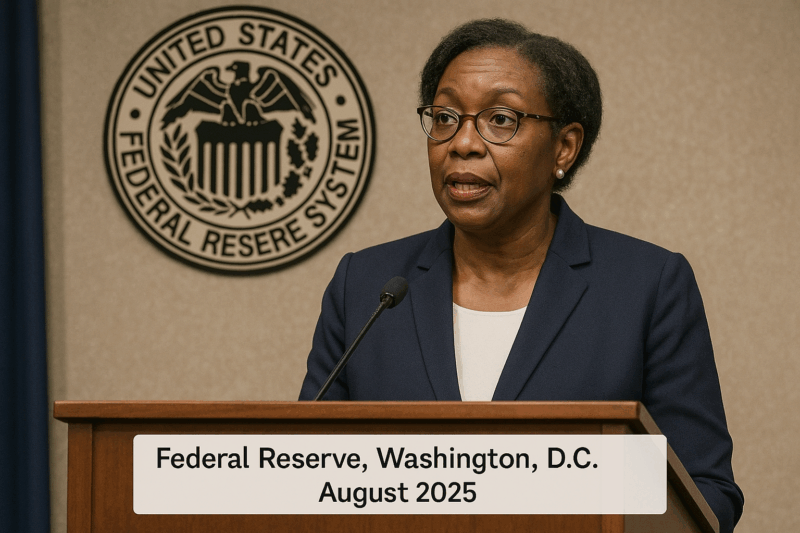

President Donald Trump announced his attempt to remove Federal Reserve Governor Lisa Cook, citing unconfirmed mortgage fraud allegations raised by Federal Housing Finance Agency Director William Pulte. Cook, the first Black woman to serve on the Fed’s Board of Governors, has vowed to fight the dismissal, asserting that Trump lacks the legal authority to fire her. This unprecedented move escalates Trump’s campaign to influence the independent central bank, raising concerns about its autonomy and sparking a likely court battle.

Human Toll

The attempt to oust Lisa Cook has sent shockwaves through the Federal Reserve and the broader financial community, undermining confidence in the institution’s independence. Cook, a respected economist with a term extending to 2038, faces personal and professional scrutiny, with her reputation at stake despite no formal charges. The public nature of the allegations, amplified by Trump’s Truth Social posts, has intensified pressure on Cook and her family. Employees at the Fed and financial markets are also rattled, as evidenced by a sharp decline in the U.S. Dollar Index following the announcement.

Political and Social Impact

The targeting of Cook, alongside other high-profile Democrats like Sen. Adam Schiff and New York AG Letitia James, has fueled accusations of political vendettas. Critics, including Sen. Elizabeth Warren, argue that Trump’s actions are an authoritarian attempt to scapegoat Cook for his economic policy challenges, further polarizing public discourse.

Key Facts About the Controversy

- Trump’s Action: On August 25, 2025, Trump posted a letter on Truth Social, claiming authority under Article II and the Federal Reserve Act to remove Cook “effective immediately” based on Pulte’s criminal referral alleging mortgage fraud. No formal charges have been filed, and the Justice Department is reviewing the claims.

- Cook’s Response: Cook, backed by attorney Abbe Lowell, asserts that Trump’s attempt lacks legal basis, as the Federal Reserve Act allows removal only “for cause,” typically malfeasance or misconduct. She refuses to resign and plans to continue her duties.

- Allegations: Pulte claims Cook falsified documents by listing properties in Ann Arbor, Michigan, and Atlanta, Georgia, as primary residences in 2021 to secure favorable loan terms. Cook’s financial disclosures show three 2021 mortgages, but no public evidence confirms fraud.

Legal and Economic Context

The Federal Reserve Act of 1913 limits presidential power to remove Fed governors, requiring “cause” such as proven misconduct. Legal experts, including Columbia Law’s Lev Menand, argue that unproven allegations from before Cook’s 2022 Fed appointment are insufficient grounds for removal. A May 2025 Supreme Court ruling emphasized the Fed’s unique independence, suggesting Trump’s action could face significant legal challenges. Economically, the move risks destabilizing markets, as seen in the U.S. Dollar Index drop, and could undermine global confidence in the Fed’s autonomy.

Why This Matters

Cook’s potential removal would allow Trump to appoint another governor, following his nomination of Stephen Miran, potentially shifting the Fed’s balance toward his agenda. With Fed Chair Jerome Powell’s term ending in May 2026, Trump’s actions signal a broader effort to influence monetary policy, raising alarms about politicizing the central bank.

What Lies Ahead

Cook’s refusal to resign sets the stage for a legal battle, likely reaching the Supreme Court, which could take months to resolve. The Justice Department’s investigation into the allegations continues, but proving criminal liability remains challenging without concrete evidence. Meanwhile, Trump’s pressure on the Fed, including attacks on Powell and other governors, may intensify as he seeks to install loyalists. Financial markets and policymakers will closely watch the outcome, as it could reshape the Fed’s independence and U.S. economic policy.

Conclusion

President Trump’s attempt to fire Federal Reserve Governor Lisa Cook over unproven mortgage fraud allegations marks a historic challenge to the central bank’s independence. As Cook vows to fight back legally, the controversy underscores tensions between executive power and institutional autonomy. With potential market and policy implications, this dispute demands close attention. Stay informed and support efforts to preserve the Federal Reserve’s independence through advocacy and engagement.